College Education, Life on Campus

How to Use a Net Price Calculator to Estimate Your True College Cost

Editorial Staff

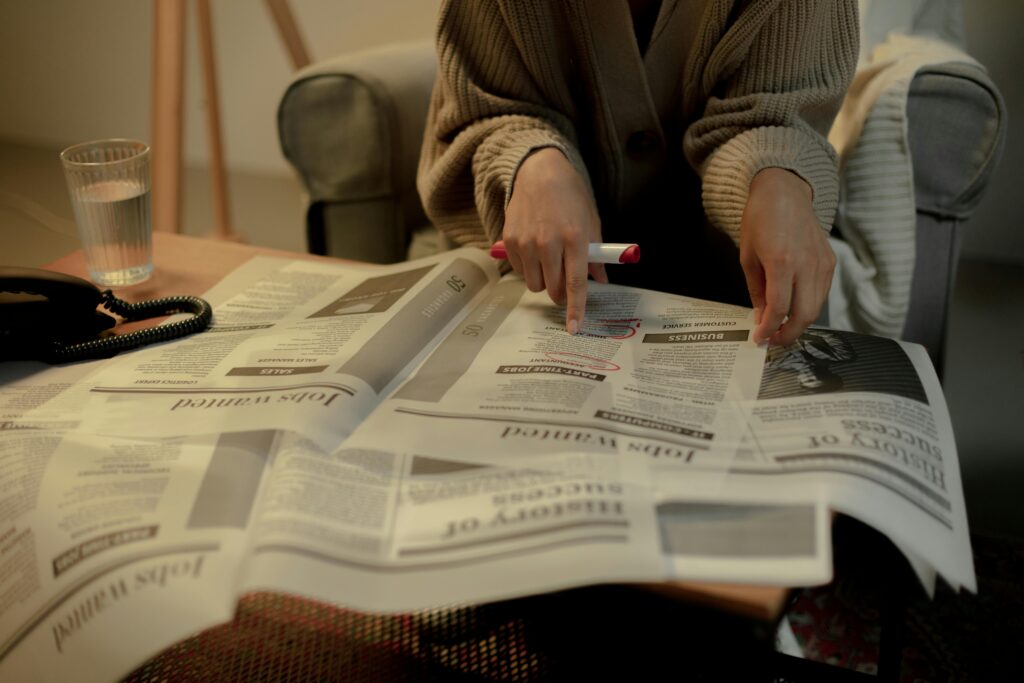

The moment college searches begin, numbers appear everywhere. Tuition pages show large figures that feel overwhelming at first glance. Many students pause right there, wondering if college is even affordable. That reaction is normal, but it is also incomplete.

The price shown online is rarely what most students actually pay. Financial aid, grants, and school-based support change the final amount more than many expect. The problem is not cost alone. The problem is uncertainty. This uncertainty makes planning stressful and decisions harder.

Students need clearer answers early, not after acceptance letters arrive. That is where the right estimation tools become helpful. We explain how to use one wisely, what information matters most, and how results should guide smarter planning decisions.

What Is a Net Price Calculator?

A net price calculator is an online tool offered by nearly every accredited college. Its purpose is simple but important. It estimates what a student may pay after grants and aid are applied. Instead of relying on general tuition listings, it focuses on personal household information. This makes the estimate more realistic and useful. Students usually find these tools on college financial aid pages. While results are not final offers, they help shape expectations early. That early clarity can reduce stress and improve decision-making.

This tool considers several personal factors before showing results. Common inputs include income, family size, and enrollment status. Some colleges also factor in academic details for merit-based support. The output breaks down tuition, aid, and estimated remaining costs. Used correctly, this tool helps students understand affordability before committing time and money to applications.

How a Net Price Calculator Works

A net price calculator works by converting personal financial details into a clearer estimate of college expenses. Students usually begin by locating the tool on a college’s financial aid page and entering household income, family size, and enrollment details. Some calculators also request academic information to estimate eligibility for merit-based aid. Once the information is submitted, the system applies school-specific formulas to project grants, scholarships, and remaining costs.

To interpret these results correctly, using a reliable net price calculator guide helps readers understand what each number actually reflects. These estimates work best when supported by clear, student-focused explanations. Guidance from OnCampus College Planning resources helps families place these numbers in context without treating them as final offers. The results should be viewed as planning benchmarks that support early comparisons between schools. Reviewing multiple estimates encourages realistic budgeting and smarter decisions before applications, financial aid discussions, and long-term education planning begin.

What Information Do You Need Before Starting?

Preparing the right information makes the process smoother and more accurate. Students should gather financial details before opening any calculator. This reduces errors and confusion later. Most tools ask for household income and filing status. Family size also matters, especially if siblings attend college. Academic details may appear as optional fields on some platforms. Having documents ready saves time and avoids guesswork.

Helpful details to prepare include:

- Recent tax return information

- Number of dependents in the household

- Current high school or college enrollment status

- Academic records, if requested

Accurate entries lead to better estimates. Rushed or guessed inputs often create misleading results. Taking time upfront improves confidence in the numbers provided.

Understanding Your Estimated Results

The results page can look confusing at first. Several numbers appear together, each serving a different purpose. Tuition and fees show the base cost of attendance. Grants and scholarships appear as reductions. The remaining amount reflects estimated out-of-pocket responsibility. This number is the most important for planning. It helps families decide what is manageable.

It is important to remember these figures are estimates, not promises. Aid packages can change from year to year. Housing choices and enrollment decisions also affect final costs. Students should use results as guidance, not guarantees. Comparing estimates across multiple schools reveals meaningful differences that tuition lists alone never show.

Common Mistakes Students Make

Many students use estimation tools quickly without full attention. This leads to confusion later. One common mistake involves using outdated financial information. Another mistake is assuming the estimate will stay the same every year. College costs and aid packages change over time. Ignoring additional expenses also causes problems later.

Common errors include:

- Treating estimates as final financial aid offers

- Forgetting housing and book costs

- Comparing only one college estimate

- Skipping updates when finances change

Avoiding these mistakes helps students plan with realistic expectations. Thoughtful use leads to better choices and fewer surprises later.

Conclusion

Understanding college affordability starts with clarity, not assumptions. Estimation tools help students move past confusing tuition lists and focus on personal cost expectations. When used carefully, they provide early insight that supports better planning decisions. Reviewing multiple estimates creates realistic comparisons and reduces financial surprises. These tools are not perfect, but they are valuable starting points. Students who use them early approach college decisions with more confidence and control. Clear planning leads to calmer choices and stronger outcomes.

SEE ALSO: The Hidden Costs of Being a Student Online and How to Manage Them Better