Efforts by the company to appease investors are in the pipeline

Apple (AAPL) failed to appease both stockholders and analysts Wednesday, as a plan to distribute $100 billion in capital to shareholders didn’t stop the stock from plummeting Tuesday afternoon and Wednesday morning after the company’s first profit decline in ten years.

According to Reuters, at least 17 brokerage firms downgraded their price targets for Apple (AAPL) shares, with some firms slashing their future price estimates by as much as $180.

The company’s quarterly numbers, released this week, didn’t make Wall Street happy. Apple’s revenue forecast was between $33 and $35 billion, which fell short of Wall Street’s expected revenue forecast of $38 billion.

Net income was down 18 percent since last year, from $11.6 billion to $9.5 billion.

Apple is doing everything it can to reverse investor sentiment. The company said Tuesday it intends to buyback $60 billion worth of shares—the largest buyback program in history. Apple will also raise its dividend 15 percent—from $2.65 to $3.05 a share.

The company even plans to take $100 billion from its cash reserves and give it to investors; Apple previously had a record amount of cash reserves ($145 billion) and investors were eager to get their hands on part of the cash.

Apple shares peaked at $705.07 on Sep. 21, 2012, when the iPhone 5 went on sale. Since then, shares have fallen 40 percent.

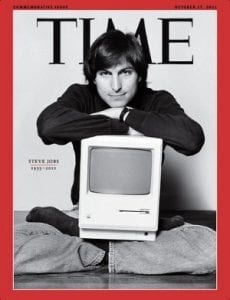

“The decline in Apple’s stock price over the last couple of quarters has been very frustrating for all of us … but we’ll continue to do what we do best,” CEO Tim Cook said on a conference call with analysts after the release of the company’s quarterly revenue numbers.

Investors are bear-ish on Apple because of a perceived failure to launch new products and innovations. Instead, the company has been releasing updates and add-ons to existing products.

“The market is tired of the same old thing at Apple,” Balter said. “Investors are looking for innovation. The reality is that people are looking at other products now and they are looking at other cool features from competitors.”

-231x300.jpg)