Campus Living, Life on Campus

Beyond the Piggy Bank: Why Every College Student Should Learn Personal Finance

Destiny Clarkson

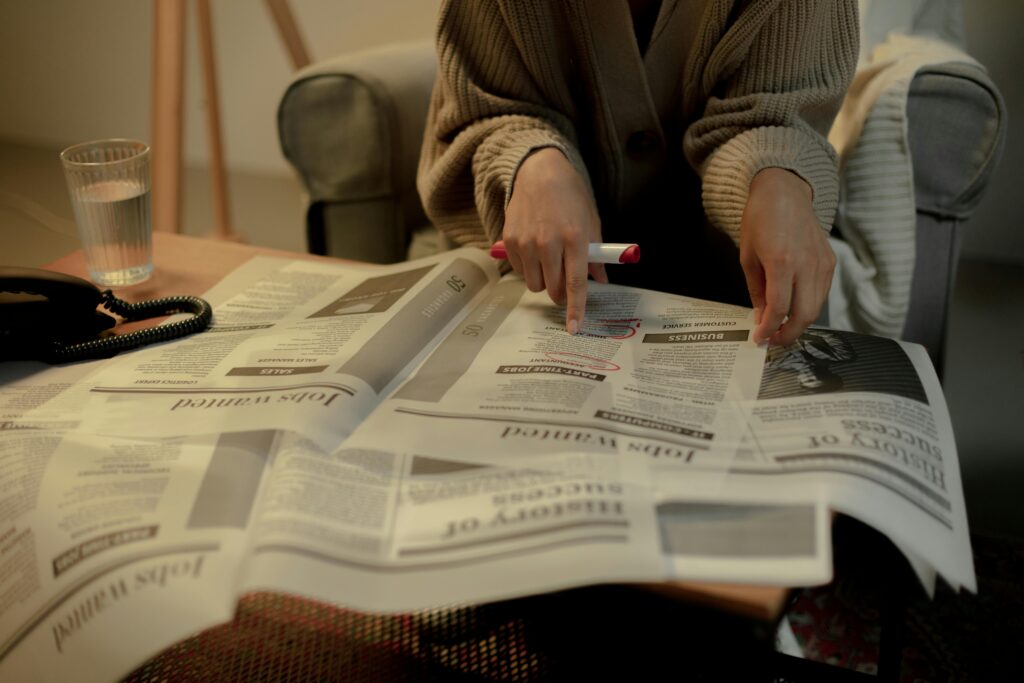

College is a time of discovery, independence, and firsts. It often includes a first apartment, first credit card, and first paycheck from a part time job or internship. These milestones bring freedom and responsibility in equal measure. Personal finance education helps students navigate this new terrain with confidence. Instead of reacting to money stress or making choices based on guesswork, students who understand the basics can set goals, protect their credit, and build habits that last long after graduation. Learning personal finance in college is not about deprivation. It is about creating options, avoiding avoidable mistakes, and shaping a future where money supports, rather than limits, what comes next.

Budgeting That Reflects Real Student Life

Traditional budgets rarely fit student life perfectly. Income may be irregular, expenses fluctuate with the academic calendar, and surprise costs appear with little warning. A student friendly budget solves for flexibility. Start with a rolling monthly plan that prioritizes essentials such as rent, utilities, groceries, transportation, and minimum debt payments. Next, estimate academic costs for the term, including textbooks, lab fees, software, and equipment. Finally, set realistic amounts for discretionary categories like social activities, eating out, and memberships.

Automating what you can makes consistency easier. Schedule rent and savings transfers on payday and leave discretionary categories for manual decisions. Use a simple rule to guide choices. One effective approach is to allocate a fixed baseline for essentials, contribute a steady amount to savings, and treat the remainder as variable. This creates room for spontaneity while preventing overspending that causes mid month panic. Review your numbers at the end of each month to adjust for new realities, then reset for the next term.

Credit, Debt, and the Power of Early Decisions

Credit history starts forming with the first loan or credit card. That history matters for future apartments, car financing, and sometimes job applications. The goal in college is not to chase points or rewards. It is to demonstrate reliability. Keeping credit utilization low, paying on time, and avoiding unnecessary accounts lays a solid foundation. One responsible starter card, used for small recurring charges and paid in full each month, can be enough to build a positive track record.

Student loans deserve equal attention. Know your loan types, interest rates, and how interest accrues during school. If you can, pay a small amount toward interest while enrolled. This reduces the compounding effect and can save a meaningful amount after graduation. Avoid borrowing more than necessary by stacking scholarships, campus employment, and targeted savings. If a refund check arrives, treat it as a tool for academic costs or future billing cycles rather than a windfall for non essential spending.

Saving and Investing With Small, Consistent Steps

Saving while in school may feel impossible. The key is to start small and make it automatic. Even ten or twenty dollars a week builds a buffer that prevents credit card reliance when a tire blows or a laptop charger fails. For longer term goals, explore a high yield savings account or a basic investment option such as a diversified index fund inside a custodial or starter brokerage account.

If you have earned income, consider a Roth IRA. Contributions can be withdrawn later without tax or penalty, which offers flexibility if plans change, while earnings grow tax advantaged for long term goals. Many students believe investing requires large sums or complex strategies. In reality, time in the market is a bigger advantage than a perfect plan. Starting small during college gives your money more years to grow and teaches you how to navigate market ups and downs without emotional decision making.

Student Income, Taxes, and the Hidden Curriculum

College work often includes internships, freelance gigs, or part time roles with uneven schedules. These income sources can create tax questions that feel intimidating at first. Keep basic records of what you earn and any costs related to that work, such as software, travel, or supplies. Understand how withholding works on paychecks and set aside a portion of freelance income for taxes if none is withheld. This simple habit prevents an expensive surprise in April.

Financial aid and tax credits also matter. Learn how scholarships and grants interact with taxable income, and know which education credits you or your family might claim. Filing a simple return each year builds familiarity with the process. As your financial life grows more complex, guidance from campus resources, community workshops, or a financial planner in Denver or your area can help you connect the dots between today’s choices and tomorrow’s opportunities.

Money Mindset and the Habits That Compound

Personal finance is as much about behavior as it is about math. Stress, social pressure, and decision fatigue can derail even the best plan. Build habits that reduce friction. Use checklists for monthly money tasks, set calendar reminders for bill due dates, and create a separate account for savings so it is not always in view. When you make a mistake, treat it as information rather than a verdict. Adjust the system and keep going.

Align your money with your values. If travel matters to you, create a travel fund and add to it consistently. If you want to graduate with fewer loans, make a small extra payment each month. Celebrate wins to reinforce momentum, such as hitting a mini savings goal or negotiating a higher internship rate. These actions build confidence, which in turn supports better decisions in moments that feel uncertain. Over time, the combination of small steps and thoughtful reflection creates lasting financial resilience.

Conclusion

Personal finance education belongs in every college experience because it turns uncertainty into strategy. Budgeting that adapts to student life, conscious credit use, small but steady saving, and basic tax awareness all add up to a foundation that supports the years ahead. Money choices made during college have a long tail. With structure, curiosity, and a willingness to learn, students can leave campus with more than a diploma. They can graduate with practical tools, healthy habits, and a sense of control that makes the next chapter less stressful and more expansive.

SEE ALSO: The Effect of TikTok and Instagram on Campus Popularity and Culture