Graduation is the perfect time to be thinking about financial planning

If you have just graduated from college it is the perfect time to be thinking about financial planning. While retirement might seem far off, there are other issues that you should be planning for as soon as you graduate. Student loans will be staring you in the face soon and what happens if you want to get married and start a family? Housing and car payments will also have to be planned for, so it is best to start early.

Budgeting your money and having a financial plan are insurance against not having enough money. If you plan ahead and know where your money is coming from, and where it is going, you will be in control of your finances. Knowing what you have, and what your goals are, will allow you to be proactive instead of reactive. This is exactly what you want out of a financial plan and you want to give yourself assets to get out of a crisis should one come up.

One of the easiest ways to save money is to have affordable medical coverage. You can find cheap insurance quotes online at most company websites, and in the resources section of this site. Having medical protection will make it more affordable to go to the doctor, or to the hospital if you have an emergency. Other products such as life insurance and annuities are worth looking into to help your financial planning as well.

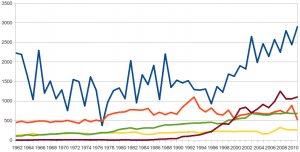

Starting a savings routine early can make it easier to take advantage of your savings. If you start putting money into a retirement account when you are 22, you will end up with roughly a million dollars more than if you start saving for retirement at age 32. That is a huge incentive to start saving as soon as you are out of college and start planning for your future.

Remember that a lot of employers will match and 401k contributions up to around 5 percent of your salary. Investing in an IRA (Individual Retirement Account) is tax deferred in some cases, so that can help you save money as well. Investing in the stock market, or mutual funds, could give you the money you need to put a down payment on a house, or support a child. Even in this down economy, the stock market is still a great place to put your money.

The bottom line is that it is never too early to save for your future and to have a solid plan for your finances. The sooner you start planning for your future, the easier it is going to be to adjust your plan should something change like your job status or you have a medical emergency.

Be sure to check out our money section for articles on banking, financial aid and bugeting.