Twitter’s IPO went up 73 percent in the stock market on Thursday morning

Twitter is now shooting into the billionaire stratosphere where social media sites like Facebook and LinkedIn are currently. With Twitter’s popularity currently multiplying exponentially day by day, it really comes as now surprise that investors tried to hoard up all the shares that Twitter was selling Thursday morning. Twitter was the most popularly traded stock on Thursday morning with 117.3 million shares being traded by the end of the day.

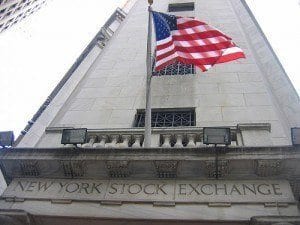

Twitter originally priced it’s IPO at 26$ on Wednesday, but the share opened at $45.10 at the New York Stock Exchange on Thursday and after climbing all the way to $50.90, the shares ultimately closed out at $44.90. This was 73% above it’s IPO price, which means Twitter is really showing their potential as the ultimate powerhouse of social media, if it continues to show this much success. The ending price of the shares would give Twitter a value of about $24.4 billion.

In wake of this success, a couple billionaires were born after the shares had such a good selling. Evan Williams, one of the founders of Twitter has stakes worth $2.6 billion, while Peter Fenton a board director of Twitter, has stakes worth $1.4 billion.

Another co-founder, Jack Dorsey, has stakes worth $1.1 billion and the CEO of Twitter has stakes worth $346 million. Probably the biggest winner was an investor named Suhail R. Rizvi, who has a 15.6 percent stake worth $3.8 billion.

Jack Dorsey made sure that Twitter would make a smooth debut on Thursday morning. “We tried to have a very clean process [for the IPO]…the team that worked on it inside of the company was very methodical,” he explained to CNBC early Thursday morning.

Facebook didn’t have such a smooth market debut back in 2012 when the stock went flat and had to have some additional help from bankers for it to gain a little momentum. Fellow social-media site, LinkedIn had a way better debut in 2011, when the stock price doubled. However, on Thursday the stock prices for Facebook fell 3.2 percent, while LinkedIn fell 4.2 percent.

The money gained from the successful public debut will go towards internal improvements for Twitter, including growing their infrastructure and creating products that will bring in more users and advertisers-which are responsible for most of Twitter’s revenue.