Spain’s regional bailouts creates a shaky central government

Spain’s economy is shaky; investors are demanding high rates to lend to the government while the politicians are trying to avert a bailout, along with regional deficit cutting into the central government’s finances.

The country’s regions seeking possible bailout puts the whole country at risk for a full international rescue—like those sought out by Greece, Ireland and Portugal. The government has to rescue its bank, from soured real estate investments, and its inability to recover money in their own financial markets.

Valencia and Murcia have said they will tap into an €18 billion emergency credit line the central government recently set up for cash-strapped regions. Catalonia is Spain’s most in debt region with a debt of €42 billion.

Investor concern about regional debt grew sharply when the central government was forced to revise Spain’s 2011 budget deficit upward for a second time to 8.9% in May—an embarrassment after four of the regions confirmed to having spent more than previously forecasted.

Interest rates on Spain’s ten-year bond benchmark went up .11% to 7.65% within the first hour of trading, but later went back down to 7.45% by early afternoon.

The country’s Ibex 35 stock index went up 2%, which helped recover only a fraction of the last three days of heavy losses.

Spain’s own central government is desperately seeking help from EU partners. Its economy is reaching its second recession in three years, mainly due to the 2008 collapse of the “property bubble” which fueled the economy. Spain denies it will need financial rescue for its public finances but many investors now think it’s only a matter of time.

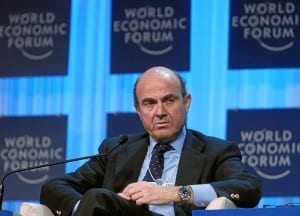

Economy Minister Luis de Guindos traveled to Paris for talks with Pierre Moscovici after meeting on Tuesday with Germany’s Wolfgang Schaeuble. Spain has been pleading for Europe’s central to buy the country’s debt to ease bond yields, but pleas have “fallen on deaf ears.”

_1.jpg)