College is the best time to learn about your finances. One financial aspect that college students do not seem to comprehend is tax planning. The truth is, tax planning brings many benefits, not only during college but also after graduation. Many students do not think they have to plan for taxes, but knowing а few basics about taxes can truly save you money, help you make smart financial choices, and even solve your debt problems later in life. This article talks about why tax planning is important for students and how they can start paying attention to it.

Understanding Tax Basics

No one talks about taxes on a daily basis, but they are a crucial part of life. Taxes need to be paid on the earnings you make from work, on any gifts given to you, and even on your scholarships. You are supposed to submit a tax return each year, which tells the government how much you earned and whether you owe them anything or they owe you. Try to be aware of deadlines since failing to do so may lead to penalties. Not taking taxes seriously is a mistake that can cost you money. These are all small steps that can save you pain and money.

Financial Benefits of Tax Planning

Tax planning is not just a boring task that accountants do. Actually, it can bring some extra money into your pocket. As a student, you may have many opportunities to save money in taxes, like tuition deductions and education-related tax credits. By planning for these ahead of time, you can often increase a tax refund or even reduce the amount of tax you have to pay. You can also keep more cash flow in savings and investments by simply knowing what not to spend. Mastering a tax plan, though it may seem hard, can reward you more than working at a job you do not enjoy.

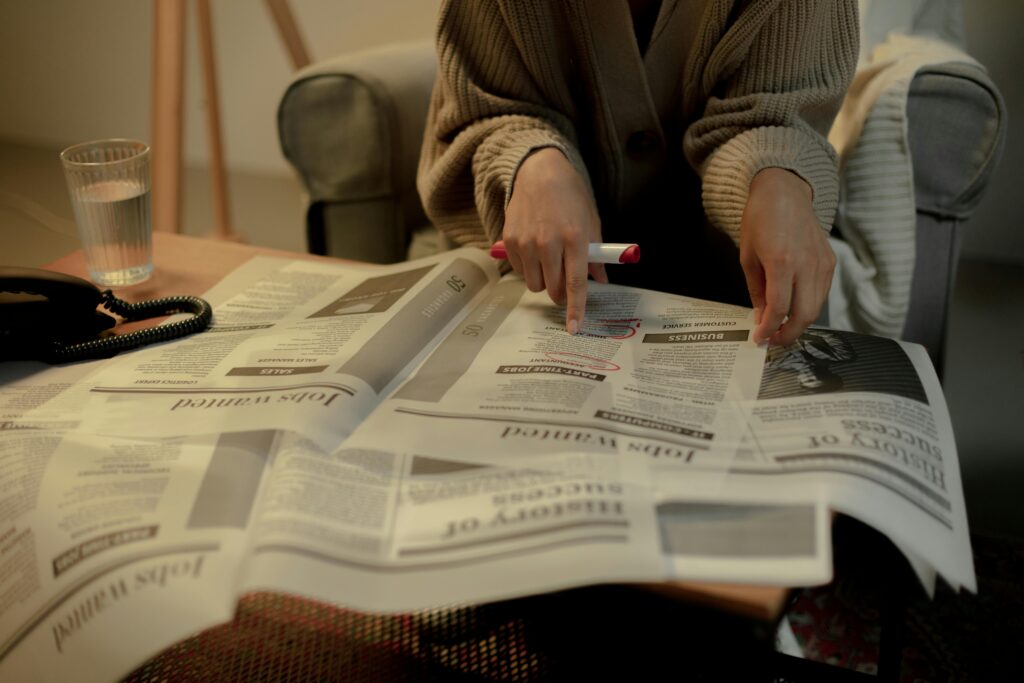

Importance of Record-Keeping

When it comes to taxes, being really organized will save you. Begin keeping all your financial documents, like pay stubs, receipts, and benefit documents. They will be handy when filling out your taxes because they will make the process a lot easier. There are many cool apps and tools that will assist you in keeping your financial stuff in order. On top of that, the habit of keeping these documents will help you conduct a simple audit in the future. Having organized records will not only make your life easier but will also make you more confident and knowledgeable about your finances.

Seeking Advice and Support

You are not supposed to know everything about taxes on your own. When you start having questions, take advantage of the many resources out there. Most universities offer a free tax assistance program, especially during tax season. Student groups often conduct sessions in basic tax knowledge. Besides, even if your case is complicated, consulting a professional tax planning advisor can help you make the right choices. Speaking to а professional before making any mistakes can save you a lot of money and time. Always remember that it is okay to seek help, and it is а sign of wise financial planning.

Common Tax Mistakes to Avoid

Any small mistake in tax filings can be a costly one. For example, simply ignoring income from tutoring, waitressing, or any job can give you nasty surprises. When you receive a scholarship, you should know what is taxed and what is not. Also, do not neglect to start a retirement account as soon as you begin receiving a salary; it will help you a lot with future taxes. There are also credits that you may miss out on, like the American Opportunity Credit, if you are not interested in learning about them. The one thing that you should never do, though, is to wait until the last moment to start filing your taxes. Each of these mistakes can be easily avoided with proper planning.

Conclusion

Tax planning is not merely a boring task; it is a useful life skill that you will need in your life. By starting a tax plan in college, you will be able to save money, lower your debt, and make life easier for yourself after school. All these quiet habits will add up, and at some point, you will realize that they are a big part of your financial journey. So do not ignore it. Keep track of your finances, seek assistance when required, and do not hesitate to ask questions. Your future self will one day congratulate you for taking taxes seriously early in life.

SEE ALSO: The Role of Student Media in Promoting Free Expression