Campus Living, Life on Campus

Student Debt Survival Guide: How to Graduate With Less Loan Stress

Destiny Clarkson

Student debt has become one of the most pressing financial challenges facing college graduates today. With tuition costs rising and living expenses climbing, many students find themselves burdened with loans before they even begin their careers. While borrowing may be unavoidable for some, there are practical strategies that can help reduce the amount of debt you take on and ease the stress of repayment after graduation.

Graduating with less loan stress isn’t just about cutting costs; it’s about making informed decisions, planning ahead, and using available resources wisely. Whether you’re just starting college or already halfway through, the following strategies can help you take control of your financial future.

Understand Your Loan Options Before Borrowing

Not all student loans are created equal. Federal loans typically offer lower interest rates and more flexible repayment options than private loans. Before accepting any loan offer, take time to understand the terms, interest rates, and repayment conditions. This includes knowing the difference between subsidized and unsubsidized loans, as well as how interest accrues over time.

Avoid borrowing more than you need. It can be tempting to accept the full amount offered, but doing so may lead to unnecessary debt. Create a realistic budget that includes tuition, fees, housing, and other essentials, and borrow only what’s required to cover the gap between your resources and expenses.

Maximize Free Money First

Scholarships, grants, and work-study programs are valuable sources of funding that don’t need to be repaid. Apply for as many scholarships as possible, even small ones, since they can add up over time. Many organizations offer scholarships based on academic achievement, community involvement, or specific fields of study.

In addition to national programs, look for local opportunities through community foundations, businesses, and civic groups. Your school’s financial aid office can also help you identify grants and work-study positions that align with your schedule and skills. Prioritizing free money over loans is one of the most effective ways to reduce your debt load.

Budget Wisely Throughout College

Living within your means during college can significantly impact how much you need to borrow. Track your spending and identify areas where you can cut costs, such as dining out, entertainment, or unnecessary subscriptions. Consider more affordable housing options, buying used textbooks, and using public transportation when possible.

Creating and sticking to a monthly budget helps you avoid relying on credit cards or additional loans for everyday expenses. It also builds good financial habits that will serve you well after graduation. If budgeting feels overwhelming, there are free apps and tools that can simplify the process and keep you accountable.

Seek Professional Guidance Early

Navigating student loans and financial planning can be complex, especially when you’re juggling academics and part-time work. Consulting with a financial advisor in Scottsdale or your local area can provide clarity and confidence in your decisions. Advisors can help you understand loan terms, explore repayment strategies, and create a long-term financial plan that includes saving, investing, and managing debt.

Even a single session with a financial professional can uncover opportunities you may not have considered, such as refinancing options, tax benefits, or employer-sponsored repayment assistance programs. The earlier you seek guidance, the more proactive you can be in minimizing debt and preparing for life after college.

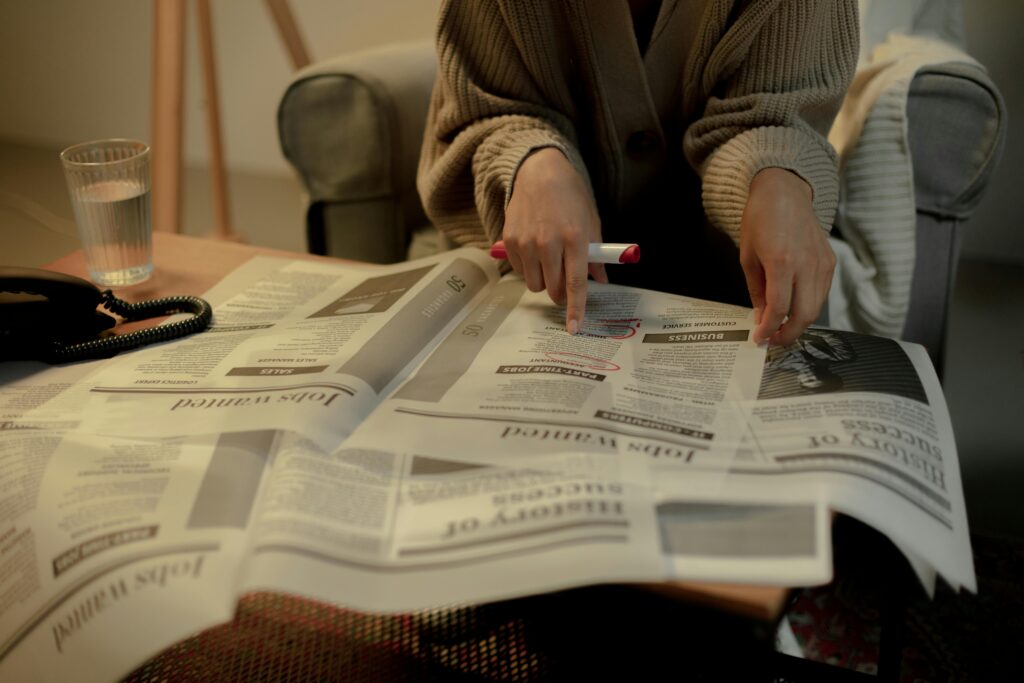

Consider Earning While Learning

Working part-time during college can help offset expenses and reduce the need for loans. While balancing work and school requires discipline, many students find that it enhances their time management skills and provides valuable experience. Look for flexible jobs that accommodate your class schedule, such as campus positions, tutoring, or freelance work.

Internships, even unpaid ones, can also lead to future job opportunities and financial benefits. Some employers offer tuition reimbursement or signing bonuses for students who intern with them. By earning while learning, you not only reduce your reliance on loans but also build a stronger resume for post-graduation employment.

Conclusion

Graduating with less student loan stress is possible with thoughtful planning and smart financial choices. By understanding your loan options, maximizing free funding, budgeting carefully, seeking professional advice, and finding ways to earn during school, you can take control of your financial future and reduce the burden of debt. These strategies not only help you survive college financially but also set the stage for a more secure and confident start to your career.